Filing your income tax return on time in Pakistan often feels stressful because of frequent rule changes, online portal issues, and fear of penalties. But once you understand the process clearly, it becomes simple and manageable. In this article, you will learn about the Last Date for FBR Tax Return 2025, the complete filing process, required documents, benefits of being a filer, and the consequences of filing late. Everything is explained in plain language so that even first-time taxpayers can follow easily.

Last Date for FBR Tax Return 2025

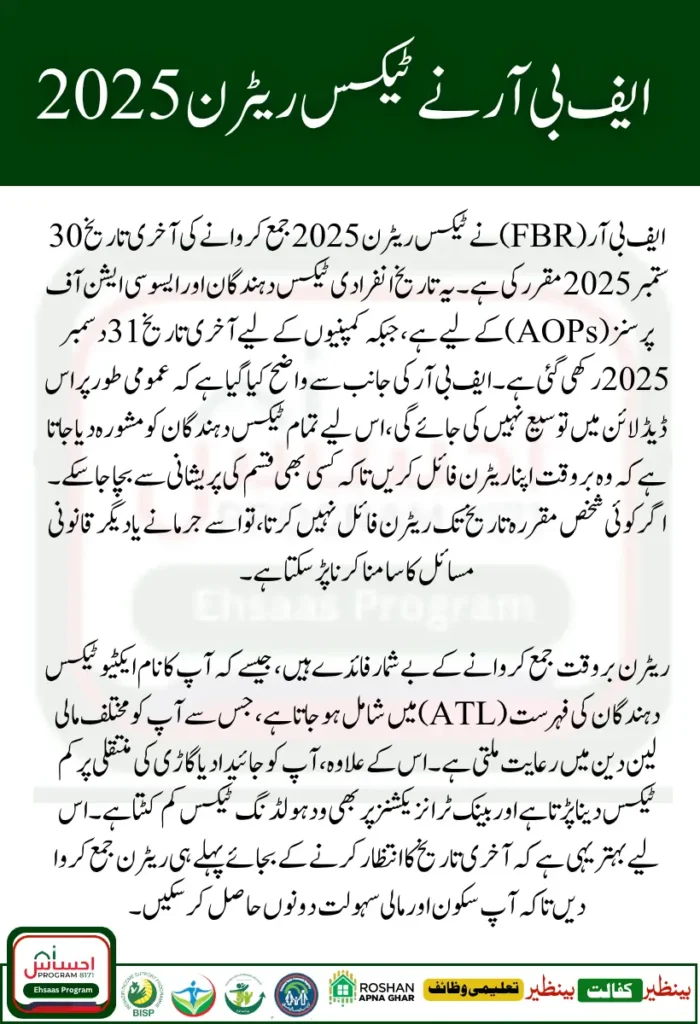

For individual taxpayers and Associations of Persons (AOPs), the last date to file the income tax return for the tax year 2025 is 30 September 2025. The Federal Board of Revenue (FBR) has already announced that this deadline will not be extended for everyone.

In special cases of genuine hardship, a short extension of up to 15 days may be considered, but only if the due tax has been paid before 30 September and approval is granted by the competent authority.

For companies and corporate entities, the standard last date to file the return is 31 December 2025, unless the company follows a special tax year.

So, for most salaried individuals, professionals, and small business owners, the Last Date for FBR Tax Return 2025 remains fixed at 30 September 2025. To avoid issues like system errors or payment delays, it is strongly advised not to wait until the last day.

Why File Before the Deadline

Many people wonder why filing before the deadline is so important. Here are some key reasons and benefits:

- You become an Active Filer, which brings multiple financial advantages.

- Lower withholding taxes on property transfers, vehicle registration, and bank transactions.

- You remain on the Active Taxpayer List (ATL), which is visible to banks and government departments.

- You avoid penalties and restrictions that apply to late or non-filers.

- If you have overpaid tax, you can easily claim refunds.

- You gain peace of mind and avoid the stress of last-minute filing or legal notices.

If you miss the Last Date for FBR Tax Return 2025, you risk:

- Being moved into the Late Filer category, which means higher withholding tax rates.

- Paying a penalty under Section 182 of the Income Tax Ordinance.

- Losing benefits and being considered non-compliant in banking or property matters.

- Facing legal notices or account restrictions in extreme cases.

Filing on time is much easier than dealing with the complications that come afterward.

You Can Also Read : How to Use the BISP Validation Portal

How to File Tax Return 2025 – Step by Step

Step 1: Register or Login to the IRIS Portal

Go to the official FBR IRIS e-filing portal.

If you already have a username and password, log in using your CNIC or NTN.

If you are new, register yourself by providing your CNIC, email, and mobile number.

Before proceeding, confirm that your personal profile (name, address, and bank details) is updated correctly.

Step 2: Select the Return Form and Tax Year

After logging in, choose the option File Income Tax Return.

Select Tax Year 2025 (covering the period from 1 July 2024 to 30 June 2025).

The system will automatically load the correct return form according to your taxpayer type. Many individuals can use the simplified income tax return form introduced for easier filing.

Step 3: Enter Your Income Details

You will need to enter information about:

- Salary income

- Business or professional income (if any)

- Income from bank profit or dividends

- Rental income (if you have property)

- Any other income sources

Also add details about:

- Deductions or tax credits

- Withholding taxes already deducted

- Assets or liabilities (if required for transparency)

Double-check every figure and make sure all entries are accurate before moving to the next section.

Step 4: Validate and Preview Your Return

Once the information is filled, use the Validate or Preview option.

The system will check your data for errors or missing fields.

If everything looks fine, you can move to the next step.

Step 5: Pay Tax Liability (if any)

If you owe tax after calculation, the system will generate a payment challan.

You can pay this amount through online banking or at designated banks.

After payment, make sure to note down the transaction number and attach proof in your return.

If your return is a nil return (no tax due) or you are expecting a refund, you can proceed directly.

Step 6: Submit and Get Acknowledgment

Click on Submit Return.

You will receive an acknowledgment receipt confirming successful submission.

Save or print a copy of this receipt for your records.

Documents and Information You Need

To make the process smooth, gather the following before you start filing:

- CNIC or NTN number

- Salary slips and withholding statements

- Bank account statements showing profit or deductions

- Dividend or investment certificates

- Rent agreement and rent income record

- Utility bills or business expense records

- Proof of any previous tax payments

- Details of assets and liabilities (if required)

- Updated contact information (email, mobile, address

Having all these ready will help you complete your return without interruptions.

You Can Also Read : PM Youth Loan Who Can Apply and What Documents Are Required 2025

Offices and Help Contacts

If you face any technical issue while filing online, you can contact or visit:

- Your nearest Regional Tax Office (RTO)

- The FBR helpdesk or helpline through the IRIS portal

- A tax consultant or chartered accountant for assistance

- The official FBR support email or complaint cell for technical support

Visiting your local FBR office can also help clarify questions about deductions, asset declarations, or tax credits.

Table: Tax Return Deadlines for 2025

| Type of Taxpayer / Entity | Last Date | Notes |

| Individual / AOP | 30 September 2025 | No general extension for taxpayers |

| Company (normal year) | 31 December 2025 | Applies to corporate entities |

| Company (special year) | 30 September 2025 | Applies if financial year differs |

This table helps you quickly identify your filing deadline.

Tips to Avoid Mistakes

- Start early and don’t wait for the final week.

- Check the portal’s working condition before the deadline.

- Use a computer instead of a mobile for accuracy.

- Review all entries and calculations before submitting.

- Keep screenshots and copies of all steps for your record.

- Stay updated with FBR announcements in case of any change.

- Consult a professional if you feel unsure about any section.

A few precautions now can save you from penalties and frustration later.

What Happens After Filing

After submission, your return goes for review by FBR.

If all details are correct, it is accepted without issue.

If there is any mismatch or missing data, FBR may send you a notice for clarification.

Refunds (if due) are processed and credited directly to your bank account.

You stay on the Active Taxpayer List as long as you file before the deadline.

Late filers may face higher deductions or temporary removal from ATL.

Keep checking your email or IRIS account for updates.

Common Errors to Avoid

- Selecting the wrong tax year

- Forgetting to claim withholding taxes or credits

- Entering wrong bank or payment details

- Submitting before attaching payment proof

- Ignoring portal error messages

Reviewing everything once again before submitting ensures accuracy.

You Can Also Read : How to Verify BISP PMT Score by CNIC

Final Summary and Key Points

- The Last Date for FBR Tax Return 2025 for individuals and AOPs is 30 September 2025.

- File online through the IRIS portal by selecting your tax year, entering income details, paying any due tax, and submitting your return.

- Keep all necessary documents ready, including salary slips, bank statements, and proof of payments.

- Avoid last-minute filing to prevent technical issues or mistakes.

- Once submitted, monitor your return status through IRIS and stay alert for FBR notifications.

- Filing on time ensures you remain an Active Filer and enjoy lower taxes and financial freedom.

FAQs

Can I get an extension beyond 30 September 2025?

There is no general extension. Only in rare hardship cases can a 15-day extension be granted, provided the due tax is paid before 30 September.

Do I still need to file if I have no tax due?

Yes. Even if your tax is nil, you must still file to maintain your status as an Active Filer.

Will I be asked to correct my return after submission?

If FBR finds any error, they may ask for clarification. However, for most ordinary taxpayers, this is not common.

How do I check if I am on the Active Taxpayer List?

After submitting your return, log in to your IRIS account or visit the FBR ATL section to confirm your name is listed.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.